Contents

- 1 Tax Court Ruling on RRSP Election and Substantial Compliance

- 2 RRSP Issue

- 3 Income and Distributions

- 4 IRS Examination of Taxpayer

- 5 IRS’ Position

- 6 Taxpayer Position

- 7 Tax Treaty

- 8 The Requirement to Timely File

- 9 The Requirement to File for Each Taxable Year

- 10 Whether Mr. Dengin Filed a Return for “Each Taxable Year”

- 11 Court Concludes Taxpayer ‘Partially’ Substantially Complied

- 12 Current Year vs Prior Year Non-Compliance

- 13 Avoid False Offshore Disclosure Submissions (Willful vs Non-Willful)

- 14 Golding & Golding: About Our International Tax Law Firm

Tax Court Ruling on RRSP Election and Substantial Compliance

The RRSP is a Registered Retirement Savings Plan. It is a very common type of savings/retirement plan in Canada. Likewise, there are many US Persons who are either citizens or residents of Canada and have one or multiple RRSPs. And, unlike a TFSA or a GIC – neither of which receive tax-deferred treatment in the United States — the RRSP and RRIF receive tax-deferred treatment at the federal level — until distributions are made. In prior years, Taxpayers would have to make an annual IRS Form 8891 election in order to defer tax on income associated with the RRSP before distribution. Then, the IRS did away with the Form 8891 requirement — as well as applied the rule retroactively. The question then becomes does the rule apply retroactively in a situation in which no tax return was filed for that year. Here, the US Tax Court ruled the taxpayer ‘substantially complied’ with two of the three RRSPs — noting he was a US citizen at birth who was unaware until later in life that he was required to file US tax returns. Let’s take a look at the Tax Court’s analysis with a focus on key excerpts from the ruling.

RRSP Issue

-

-

-

Pending before the Court is the Commissioner’s Motion for Partial Summary Judgment, asking the Court to conclude that Mr. Dengin failed to make a proper election. Mr. Dengin substantially complied with Revenue Procedure 2014-55 as to the accounts opened and held during the tax years for which he filed returns. That revenue procedure was retroactive to the years in issue and eliminated the timely return requirement. Because he did not file returns for tax years earlier than 2006, he failed to make an election with respect to the plan opened before 2006.

-

-

Income and Distributions

-

-

-

During the time Mr. Dengin owned the RRSP accounts, their fair market value increased because of his investment activities. He did a substantial amount of stock trading within and between these accounts. Under Canadian law, the gain earned in Mr. Dengin’s RRSP accounts did not result in taxable income until he received a distribution. See Income Tax Act, R.S.C. 1985, c. 1 (5th Supp.), § 146(8).

-

Dengin began taking withdrawals from RRSP Account 3 in 2011. That year, he received a distribution of $3,548,252

-

-

-

IRS Examination of Taxpayer

-

-

-

In 2012, the Commissioner commenced a federal income tax examination for Mr. Dengin’s 2006 through 2011 tax years. When the examination began, Mr. Dengin did not have a Social Security number, nor had he ever filed a U.S. individual income tax return. He was unaware of his U.S. tax filing requirements, and as a result, had not sought advice about those requirements from his longtime accountant.

-

On his 2011 return, he reported the $3,548,252 distribution from RRSP Account 3 as taxable income from pensions and annuities.

-

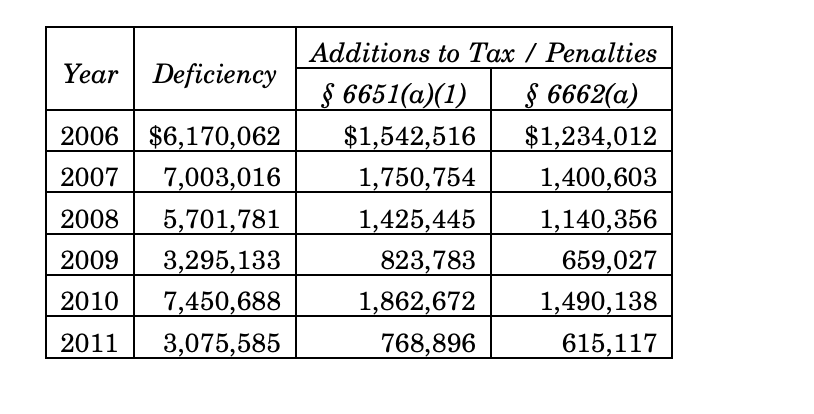

In 2016, Mr. Dengin relinquished his U.S. nationality. He made a formal renunciation of his U.S. nationality on October 3, 2016, which the U.S. State Department approved on November 3, 2016. Mr. Dengin notified the IRS of his expatriation in 2017. On December 8, 2016, the Commissioner sent Mr. Dengin a notice of deficiency for 2006 through 2011. The adjustments in that notice were based on the Commissioner’s determination that Mr. Dengin was subject to U.S. tax on undistributed earnings in his RRSP accounts for the years in issue because he failed to make the election to defer taxation under Article XVIII(7).4 The determinations are as follows:

-

-

-

-

-

While residing in Canada, Mr. Dengin timely petitioned the Tax Court. In the Petition, he alleges that the Commissioner erred in including income accrued in his RRSP accounts as taxable income for each year in issue.

-

-

IRS’ Position

-

-

-

Pending before us is the Commissioner’s Motion for Partial Summary Judgment asking us to decide whether capital gain and interest income that accrued in Mr. Dengin’s RRSP accounts is includible in his taxable income for the years in issue. The Commissioner argues that Mr. Dengin did not make a proper election to defer U.S. tax on undistributed earnings in his RRSP accounts pursuant to Article XVIII(7).

-

-

Taxpayer Position

-

-

-

Mr. Dengin objects to this Motion, alleging that the income is not includible in his taxable income for the years in issue because he met or substantially complied with the requirements to make the tax deferral election.

-

-

Tax Treaty

-

-

-

The latest version of Article XVIII(7), as amended by Protocol 5, provides:

-

-

A natural person who is a citizen or resident of a Contracting State and a beneficiary of a trust, company, organization or other arrangement that is a resident of the other Contracting State, generally exempt from income taxation in that other State and operated exclusively to provide pension or employee benefits may elect to defer taxation in the first-mentioned State, subject to rules established by the competent authority of that State, with respect to any income accrued in the plan but not distributed by the plan, until such time as and to the extent that a distribution is made from the plan or any plan substituted therefor.[7]

-

-

-

Essentially, this article provides that a U.S. citizen or resident can elect to defer U.S. tax on income that accrues in a Canadian retirement account until a distribution is made from that account. While Article XVIII(7) enables taxpayers to elect deferral, it does not inform them how to make this election. Instead, it grants each country the power to establish rules for making an election. In the United States this power is vested in the IRS. The IRS has issued several revenue procedures and notices detailing the requirements an individual must satisfy to make this election.

-

-

The Requirement to Timely File

-

-

-

The Commissioner argues that Mr. Dengin is not an eligible individual under Revenue Procedure 2014-55 because he did not timely file U.S. tax returns as required under section 4.01(B). Mr. Dengin argues that there is no timeliness requirement under that section. We agree with Mr. Dengin; there is no requirement in section 4.01(B) that the returns be timely filed.

-

-

The Requirement to File for Each Taxable Year

-

-

-

The Commissioner argues that Mr. Dengin is not an eligible individual under Revenue Procedure 2014-55 because he did not “[file] a U.S. federal income tax return for each taxable year during which [he] was a U.S. citizen” as required under section 4.01(B). We understand the Commissioner to have interpreted “each taxable year” to include each year in which a taxpayer has received taxable income. The Commissioner therefore argues that because Mr. Dengin has filed returns only for 2006 to 2011, he does not satisfy this requirement.

-

The Commissioner’s argument runs contrary to his own guidance issued contemporaneously with Revenue Procedure 2014-55. On the same day Revenue Procedure 2014-55 was issued, the IRS issued a news release that summarized the revenue procedure and its applicability. See I.R.S. News Release IR-2014-97. The news release stated that U.S. citizens and residents would automatically qualify for the tax deferral election “as long as they filed and continue to file U.S. returns for any year they held an interest in an RRSP . . . and include any distributions as income on their U.S. returns.” Id. This guidance provides a more lenient interpretation of “each taxable year.”

-

Mr. Dengin argues that he has satisfied this requirement for RRSP Account 2 and RRSP Account 3. He interprets “each taxable year” as “each taxable year in which the taxpayer had the RRSP account for which the deferral is requested.” He therefore argues that, because he is requesting deferral only for his RRSP accounts held from 2006 to 2011, and he filed returns for those years, he has satisfied section 4.01(B). On 13 [*13] the basis of the discussion below, we find that Mr. Dengin does not strictly satisfy this requirement for RRSP Account 1, 2, or 3.

-

-

Whether Mr. Dengin Filed a Return for “Each Taxable Year”

-

-

-

We need not decide the precise meaning of “each taxable year” because under any reasonable interpretation of “each taxable year,” Mr. Dengin fails to strictly satisfy Revenue Procedure 2014-55, § 4.01(B), for RRSP Accounts 1, 2, and 3. The phrase “each taxable year” could be interpreted as either (1) for each year a taxpayer receives taxable income or (2) for each year the taxpayer holds an interest in an RRSP. We will consider the facts under both interpretations, but Mr. Dengin does not satisfy the requirements under either interpretation.

-

But Mr. Dengin also fails to satisfy the less stringent requirement that he have filed tax returns for each year he was a beneficiary of an RRSP account. To qualify for relief under this approach, Mr. Dengin must have filed a U.S. return for each year in which he was a beneficiary of an RRSP account. Because Mr. Dengin was a beneficiary of RRSP Account 1 before 2006, and he did not file a U.S. return before 2006, he does not satisfy this requirement.

-

-

Court Concludes Taxpayer ‘Partially’ Substantially Complied

Here, the election automatically applies if the taxpayer is an eligible individual. Therefore, to comply with the section 4.01(B) requirement in substance, the taxpayer must file tax returns for each year they are the beneficiary of the plan for which they are seeking deferral. The taxpayer does not have to provide information with the returns to alert the IRS that the election was made. Furthermore, as we conclude above, the filings do not have to be timely. We look to each relevant RRSP account separately to determine whether Mr. Dengin substantially complied with this requirement.

RRSP Account 1

-

-

-

Mr. Dengin did not substantially comply with the section 4.01(B) requirement for RRSP Account 1. RRSP Account 1 was opened before 2006, and Mr. Dengin failed to file a return for each year he was a beneficiary of that account.

-

-

RRSP Account 2

-

-

-

Mr. Dengin substantially complied with the section 4.01(B) requirement for RRSP Account 2. RRSP Account 2 was opened and closed in 2006, and Mr. Dengin filed a tax return for that year.

-

-

RRSP Account 3

-

-

-

Mr. Dengin substantially complied with the section 4.01(B) requirement for RRSP Account 3. He filed a return for each year he was the beneficiary of the account. Furthermore, Mr. Dengin also attached Form 8891 with each return from 2006 to 2011, providing the name and number of the account, the address of the account, his name as the beneficiary, and the plan balance.

-

-

Current Year vs Prior Year Non-Compliance

Once a taxpayer has missed the tax and reporting (such as FBAR and FATCA) requirements for prior years, they will want to be careful before submitting their information to the IRS in the current year. That is because they may risk making a quiet disclosure if they just begin filing forward in the current year and/or mass filing previous year forms without doing so under one of the approved IRS offshore submission procedures. Before filing prior untimely foreign reporting forms, taxpayers should consider speaking with a Board-Certified Tax Law Specialist that specializes exclusively in these types of offshore disclosure matters.

Avoid False Offshore Disclosure Submissions (Willful vs Non-Willful)

In recent years, the IRS has increased the level of scrutiny for certain streamlined procedure submissions. When a person is non-willful, they have an excellent chance of making a successful submission to Streamlined Procedures. If they are willful, they would submit to the IRS Voluntary Disclosure Program instead. But, if a willful taxpayer submits an intentionally false narrative under the Streamlined Procedures (and gets caught), they may become subject to significant fines and penalties.

Golding & Golding: About Our International Tax Law Firm

Golding & Golding specializes exclusively in international tax, specifically IRS offshore disclosure.

Contact our firm today for assistance.